Built by a leadership team with 15+ years of experience scaling secure AI & data platforms for global financial institutions.

Our Services, your ease

Secure Architectures for High-Stakes Environments

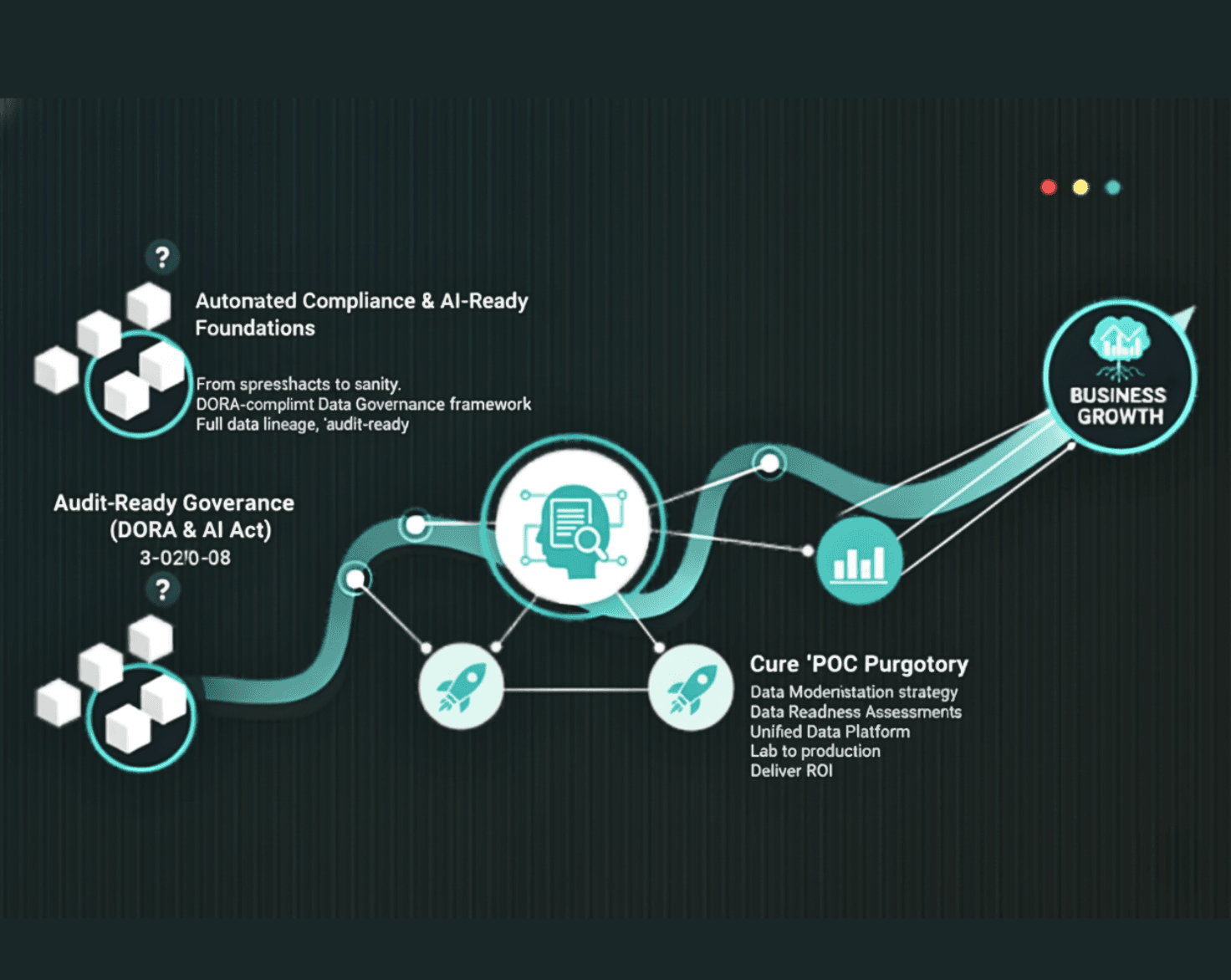

Automated Compliance & Risk

Audit-Ready Governance

Deploy AI agents that continuously monitor transactions against changing regulations (GDPR, Basel III). Reduce manual audit costs by up to 40% while ensuring 100% traceability.

Modern Data Foundation

We engineer secure data architectures that bridge the gap between legacy silos and modern AI, ensuring your data is clean, governed, and ready for advanced analytics.

Talk to our Strategists

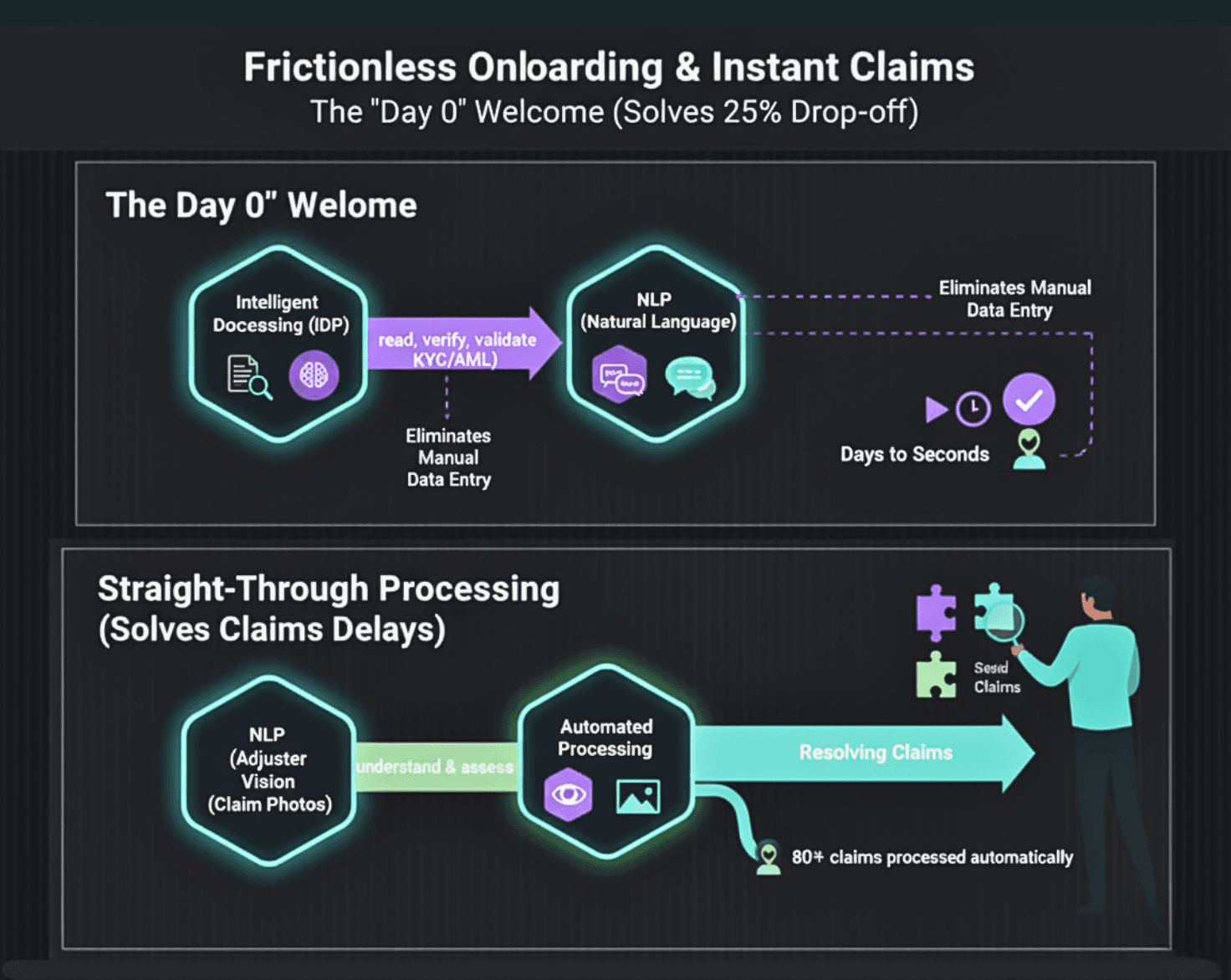

Intelligent Underwriting & Claims

GenAI Document Intelligence

Accelerate decision-making with RAG-based assistants. Instantly synthesize unstructured data from medical reports and financial statements to assess risk with greater precision.

Automated Claims Processing

Use Computer Vision and NLP to assess claim photos and adjuster notes automatically, turning "managing" claims into "resolving" them instantly.

See our AI in Action

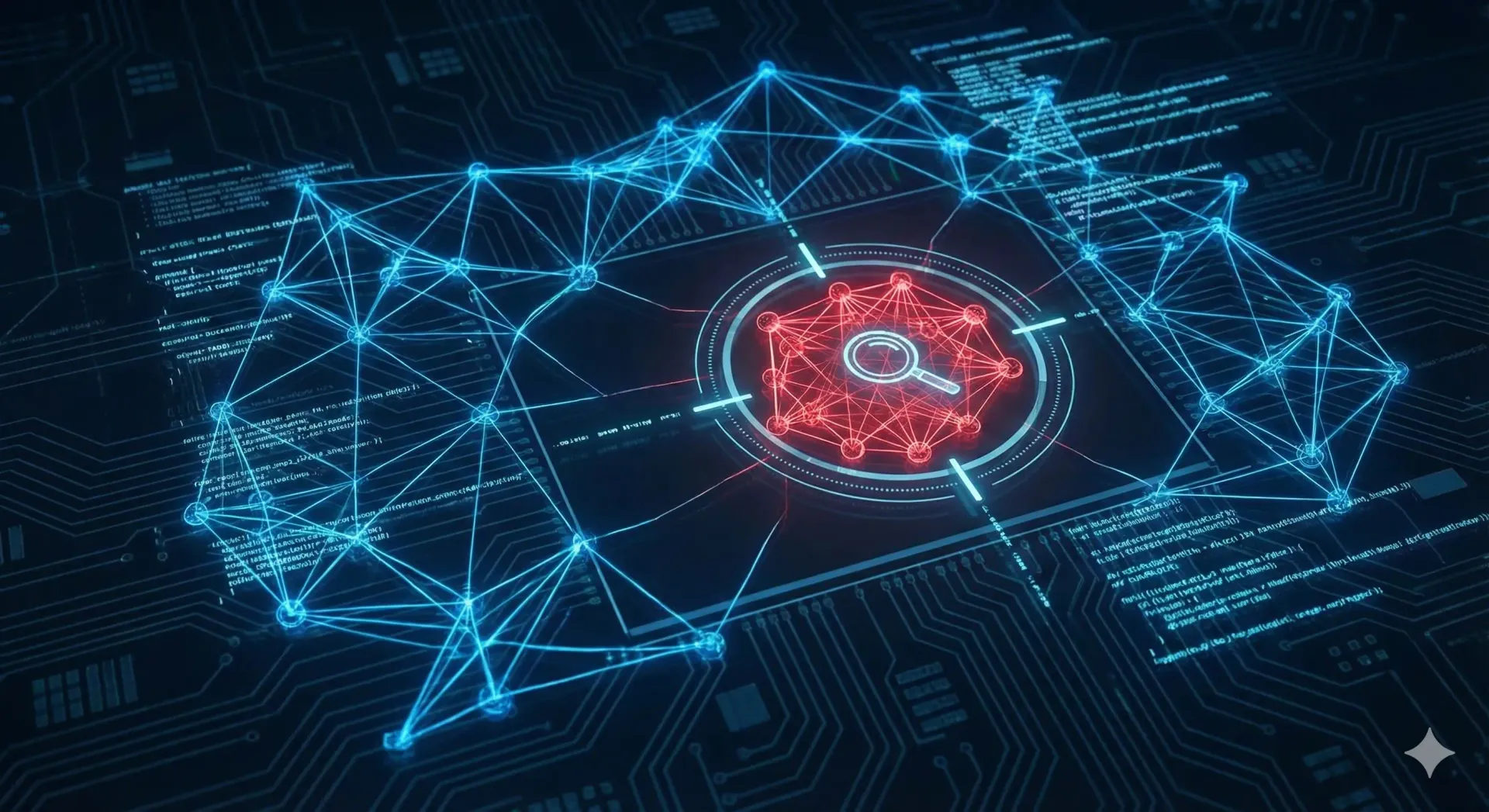

Next-Gen Fraud Prevention

Real-Time Fraud Graphs

Move from reactive rules to proactive AI. Our ML models utilize graph databases to detect complex money laundering networks and synthetic identity fraud in milliseconds.

Predictive Risk Modeling

Build and deploy explainable predictive models that inform strategy and automate decision-making across your enterprise, from credit scoring to market risk analysis.

Talk to our Data Scientists

Why Trust Us: Our Specialized Approach

Finance-Native Expertise

We aren't generalists. From complex KYC/AML workflows to regulatory reporting, we build "compliance-by-design" solutions that natively understand the high-stakes requirements of the financial sector.

Explainable AI (XAI) & Security

We don't build "black boxes." We build Explainable AI architectures that provide clear, auditable reasoning for every decision. Combined with ISO 27001 security standards, our solutions satisfy both your internal risk committees and external regulators.

Production-Ready ROI

We cure "POC Purgatory." By prioritizing a unified data foundation and rigorous MLOps, we bridge the gap between the lab and the real world, deploying scalable models that deliver measurable business value.

Let's Talk Data

We love data and love solving data problem. We're committed to making data understandable !

Send a message

24/7 Support.

We are based in UK, but we can support your business in any time zone, we work 24x7.

Impossible? We're on it

Difficult is done at once, the impossible takes a bit longer. If it is possible, consider it done. The impossible, it will be done!

Full spectrum of services

We provide full spectrum of enterprise data services.

Flexible work terms

We understand that every business is different. We work on both fixed cost and time and material basis. We can also provide consultants, who can work alongside your existing team.